Trending

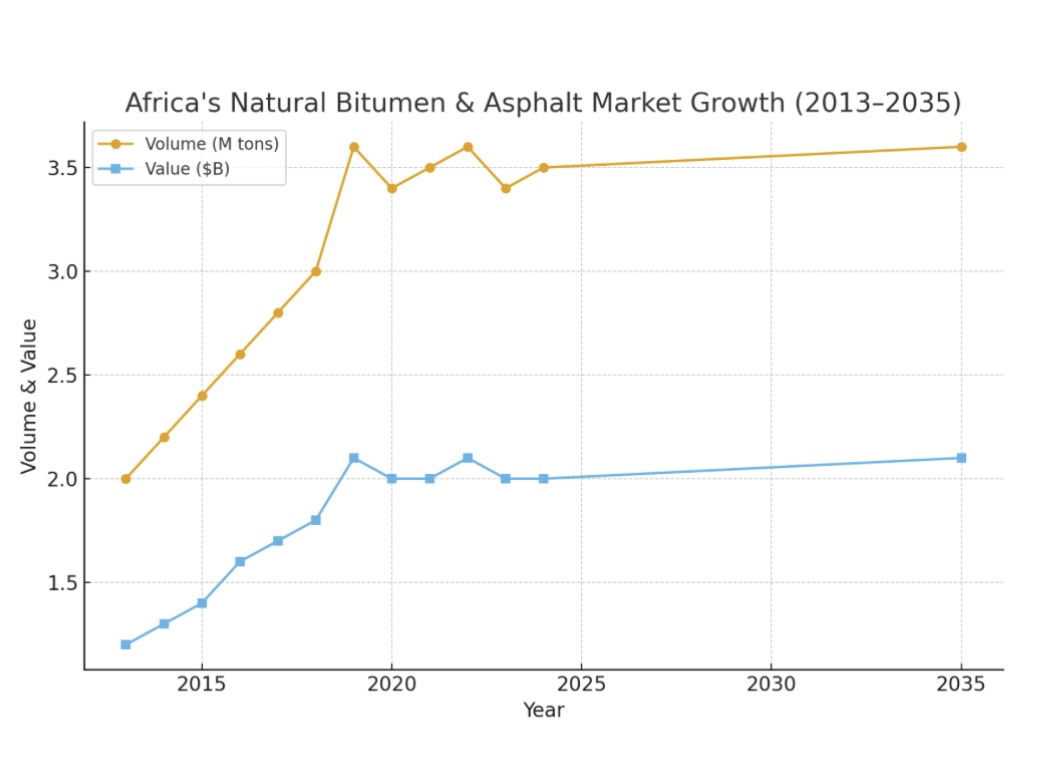

The African natural bitumen and asphalt market is expected to exhibit a modest upward growth in the next decade, but the pace of growth remains kept at bay compared to its previous periods of growth, WPB says. Market consumption is projected to stand at 3.6 million tons by the year 2035, with a marginal compound annual growth rate (CAGR) of 0.1% between 2024 and 2035. Financially, the market is projected to grow at a marginally higher growth rate of 0.6% CAGR to reach approximately $2.1 billion at the end of the forecast period.

Market Performance and Trends

The African natural bitumen and asphalt sector has displayed both resilience and volatility over the past decade. In 2024, consumption stood at 3.5 million tons, a figure almost unchanged compared with the previous year, yet notably below the 2019 peak of 3.6 million tons. Despite this slowdown, the longer-term perspective from 2013 to 2024 indicates substantial progress, with an average annual growth rate of 5.7%.

From a value perspective, the market yielded revenues of nearly $2 billion in 2024, a 8% increase over 2023. However, the data reveal a pattern of fluctuations: although market worth peaked in 2022 at $2.1 billion, subsequent years experienced the incidence of modest corrections. In general, Africa's consumption and value trends reflect a transitional market — characterized by stronger long-term demand, but tempered by cyclic declines and regional disparities.

Regional Consumption Habits

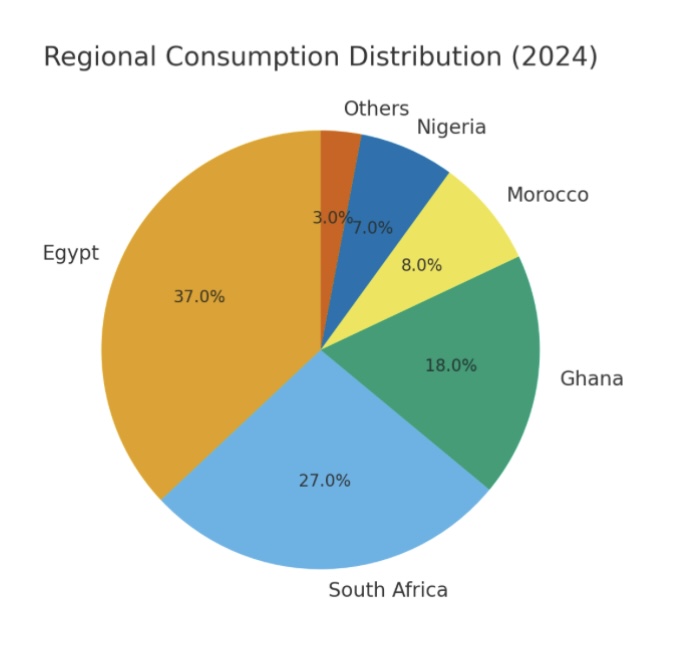

In a more detailed look at regional consumption, the dominance of several leading players is notable. Egypt, South Africa, and Ghana accounted for 82% of total demand in 2024 and solidified themselves as the continent's prime consumers. Morocco and Nigeria followed closely behind, adding collectively another 15% of the market.

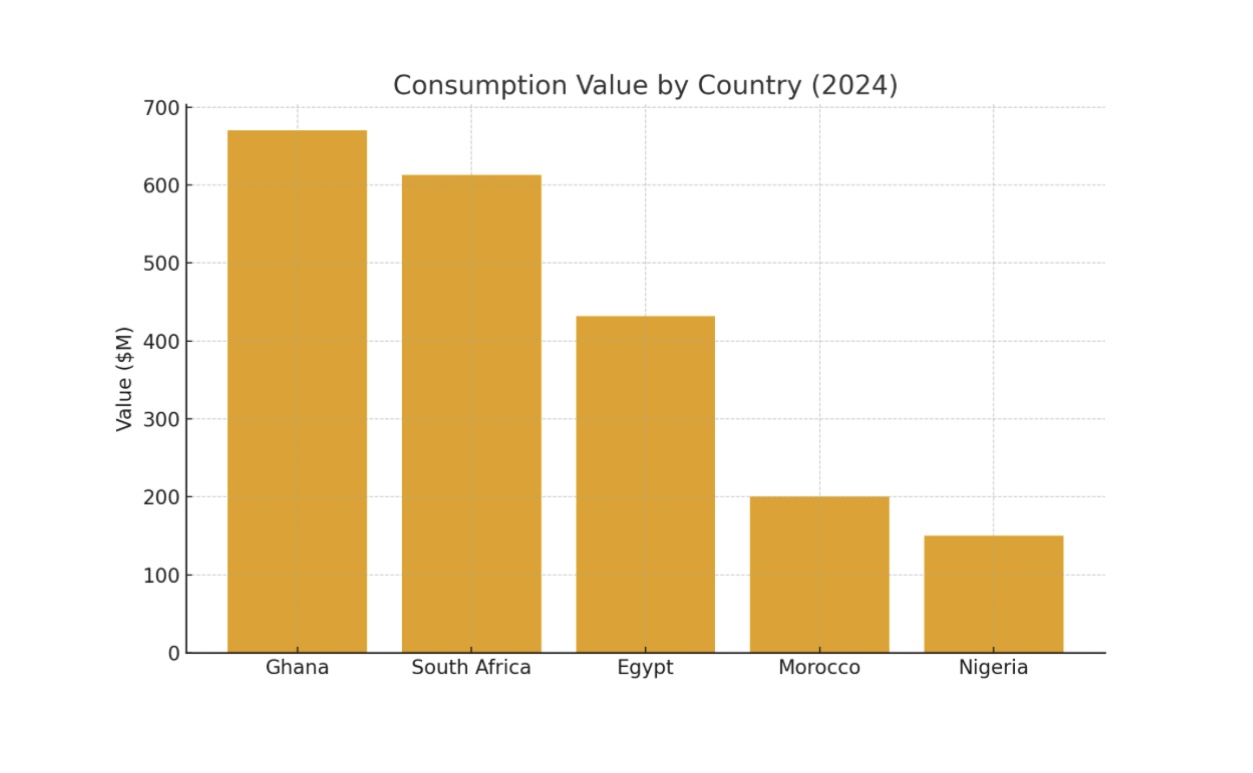

When comparing in value of consumption, the order is quite different: Ghana ($670M), South Africa ($613M), and Egypt ($432M) all controlled 85% of the market value in 2024. These figures not only indicate their high consumption levels but also the higher per-ton value placed on their markets.

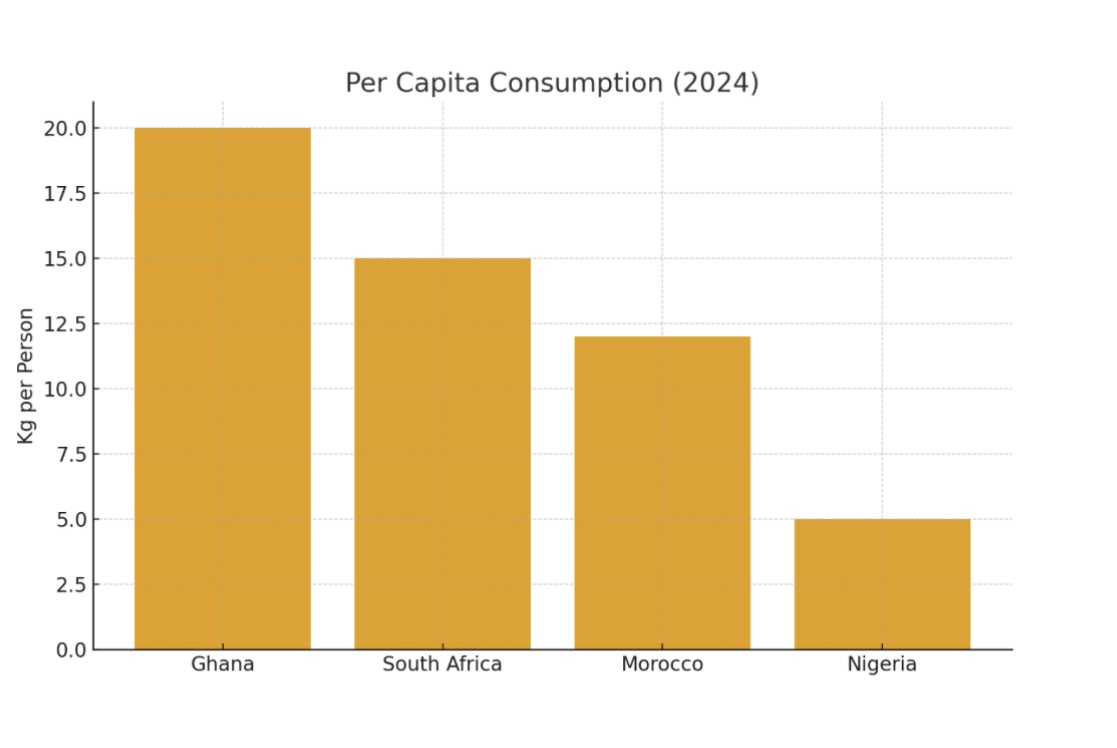

Nigeria is another extremely dynamic market. At a CAGR of more than 48% in the last ten years, Nigeria has demonstrated the highest rate of growth in Africa, reflecting its nascent position as a critical consumer. Per capita, Ghana is the highest at 20 kg per capita, followed by South Africa (15 kg per capita) and Morocco (12 kg per capita), indicating differentiated levels of infrastructure and industrial dependence on bitumen and asphalt in the region.

Production Dynamics

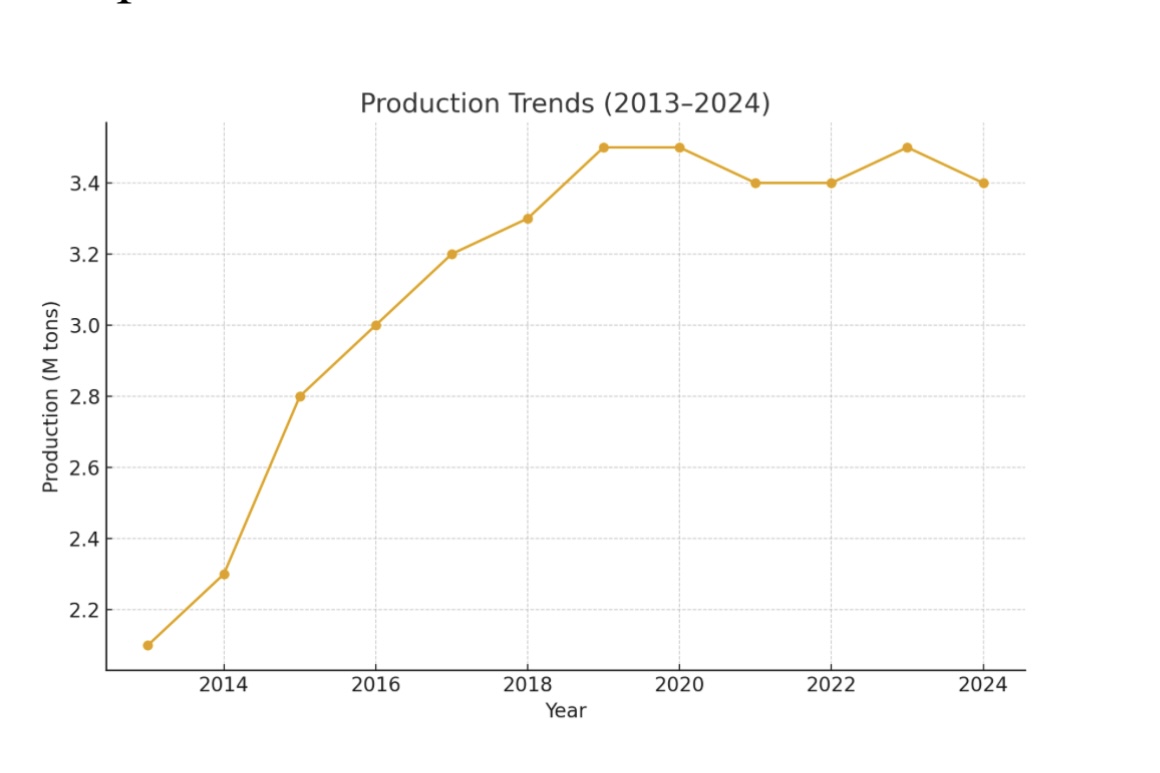

African production was steady in 2024, at 3.4 million tons. While largely the same as the previous year, this is a steady recovery trend after the 2019 high of 3.5 million tons. Between 2013 and 2024, consistent annual production growth of 6% has been driven primarily by the development of infrastructure and investment in road construction schemes.

It rose to $1.9 billion in 2024, with an average growth rate of 1.8% annually from 2013. The most significant output growth was recorded in the year 2014, with production volumes increasing by 22%. While subsequent years saw a decline, the general pattern was upward.

Geographically, Egypt, South Africa, and Ghana led the production in 2024, with their combined share of 86% of total output, while Morocco contributed another 13%. Morocco particularly recorded a strong production CAGR of 7.5% and is thus becoming more significant as a producer in the African continent.

Import Developments

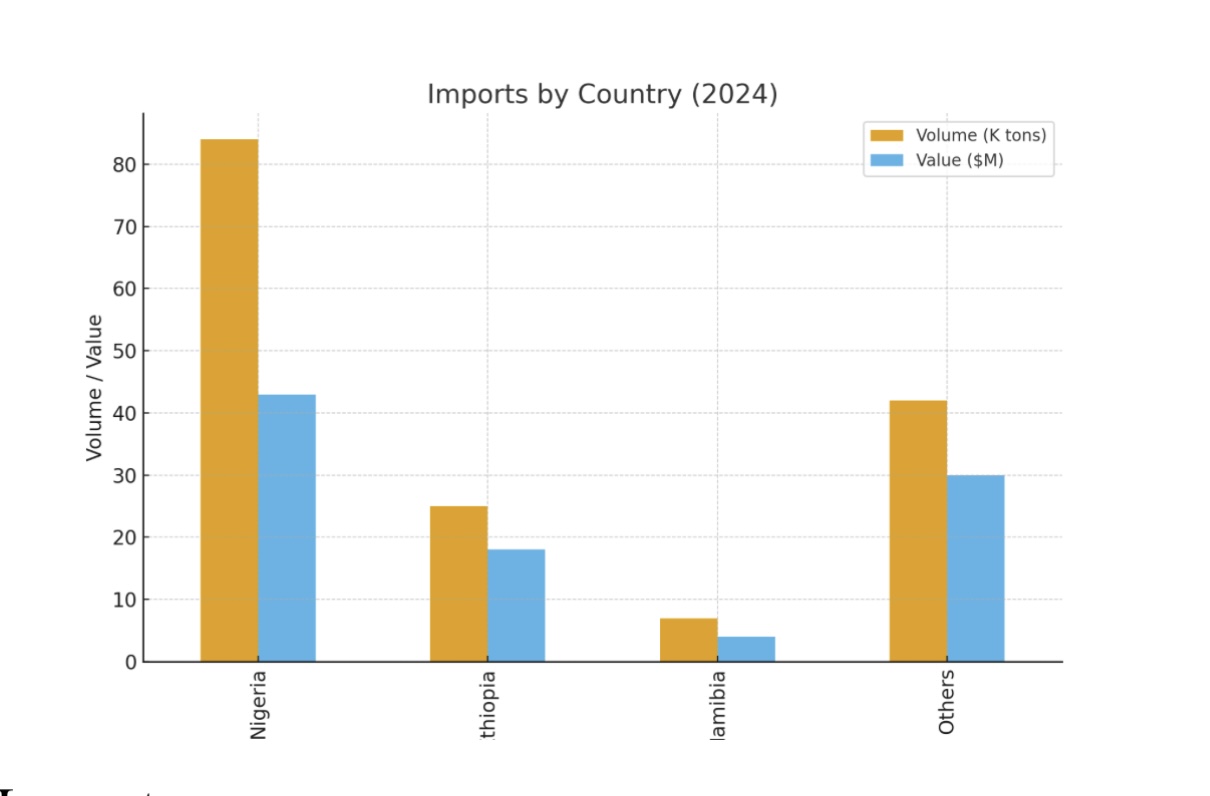

The African import profile did change significantly in 2024, with volumes of imports rising 61% year-on-year to 158,000 tons. That growth, however, needs to be seen in the context of longer-term downturn, as volumes of imports are significantly below the 210,000 tons high of 2015.

Nigeria was the largest importer, absorbing 53% of the volumes (84,000 tons), followed by Ethiopia at 16%. The smaller importers like Niger, Zimbabwe, Namibia, Uganda, Mayotte, Botswana, and Tanzania absorbed much lower proportions. In terms of value, Nigeria was also the leader at 46% of Africa's import value ($43M), followed by Ethiopia and Namibia.

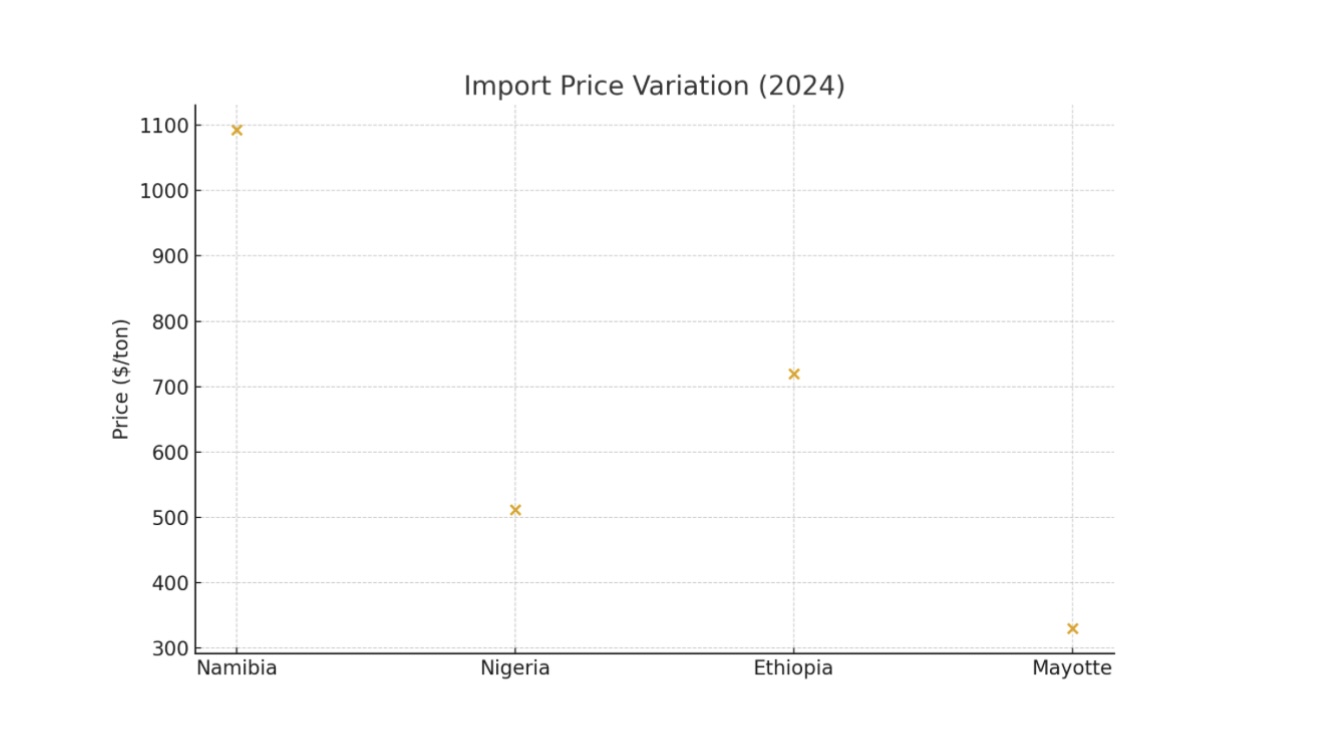

Import prices were at $603 per ton on average in 2024, decreasing by 15.2% from 2023. Price differences still persisted regionwide: Import price was highest in Namibia at $1,093 per ton, while Mayotte had the lowest at $330 per ton. Botswana was among the few importers with positive price growth over the past decade.

Export Trends

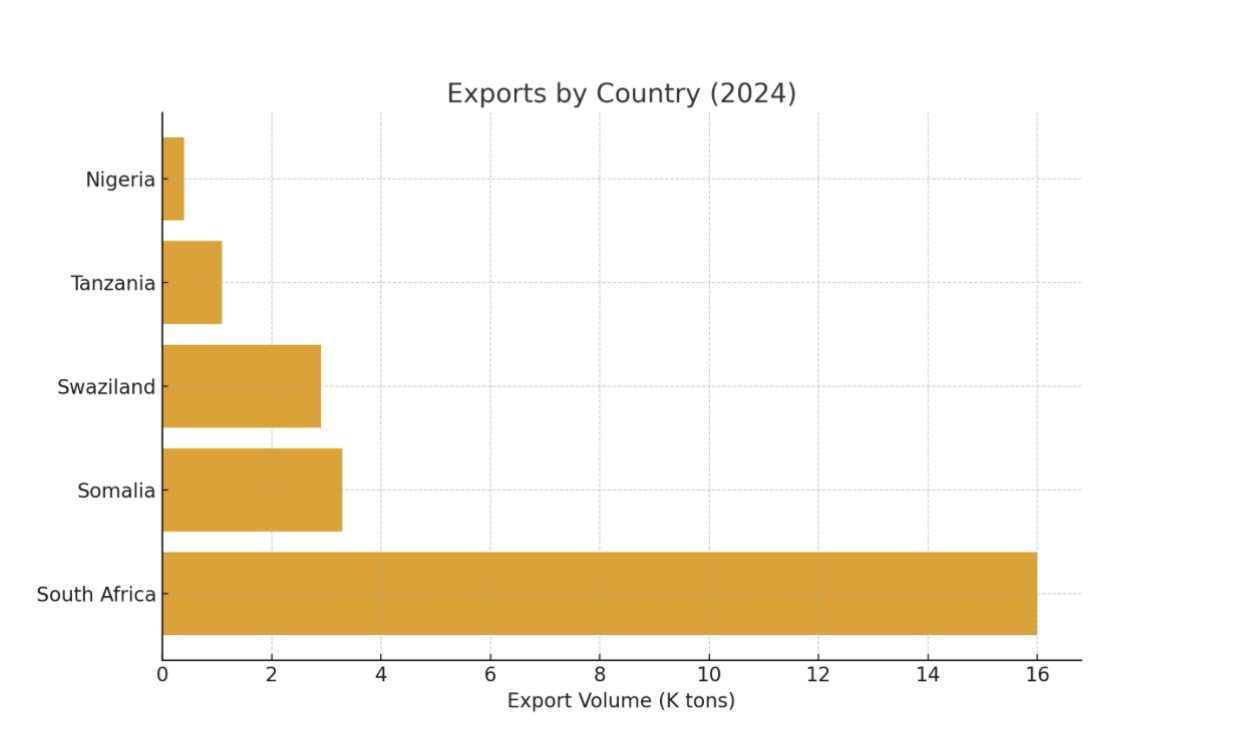

Contrary to rising imports, exports retreated sharply. Export shipments dropped to 26,000 tons in 2024, down by 19.3% from previous year and still below 2013 record high of 70,000 tons. While quantity dropped, export value increased to $25 million, mostly due to stronger prices.

South Africa remained the largest exporter with 63% of the volumes followed by Swaziland (11%) and Somalia (13%). Nigeria and Tanzania provided the smaller volumes. Somalia and Swaziland have both demonstrated high growth in export performance, with Somalia putting in a phenomenal CAGR of 51.8% over the past decade.

Export prices rose sharply, at an average of $979 per ton in 2024, a 35% rise from last year. This trend follows a since-2021 pattern and indicates rising value-added opportunities for African producers. South Africa recorded better average export prices ($861 per ton), while Nigeria reported one of the lowest ($172 per ton).

Outlook

Overall, Africa's asphalt and natural bitumen industry appears set for sustainable growth through 2035. The trajectory of the market will likely be influenced by sustained consumption in leading economies, rising import needs in fast-developing economies, and export prospects supported by stronger pricing.

Although the estimated 0.1% volume and 0.6% value CAGR rates may be considered moderate growth, the divergence of regional differences and growth opportunities between countries like Nigeria and Morocco signal vast opportunities for traders and manufacturers alike. For trade policymakers and practitioners, this changing dynamic serves to underscore the need to balance domestic production policy with trade policy that can take advantage of Africa's growing demand for infrastructure and urbanization.

By Bitumenmag

Bitumen, Oil, Market, Price

If the Canadian federal government enforces stringent regulations on emissions starting in 2030, the Canadian petroleum and gas industry could lose $ ...

Following the expiration of the general U.S. license for operations in Venezuela's petroleum industry, up to 50 license applications have been submit ...

Saudi Arabia is planning a multi-billion dollar sale of shares in the state-owned giant Aramco.