Trending

Daily Bitumen Prices

Bitumen Prices Under the Microscope: A Market Tied to Oil and Currency

Bitumen is considered one of the strategic commodities in the economy of Asia, a product on which everything from road paving in Iran and India to port building in Africa and China depends. This reliance has caused bitumen prices to be a sensitive and fluctuating metric, one that's controlled both by crude oil and foreign exchange rates. The fluctuation in the price of this black sticky liquid not only affects road construction contractors but also directs regional markets' attention towards the leading exporters of this product.

For further information, visit:

https://www.bitumenmag.com/Articles/everything-about-bitumen

Why Do Bitumen Prices Always Fluctuate?

Bitumen prices directly correlate with crude since vacuum bottom, which is the primary feedstock for bitumen manufacturing, is obtained by its distillation. Any movement in the global oil market sooner or later is reflected in bitumen prices. Currency exchange rates also play an important role. When the U.S. dollar continuously changes in those countries where bitumen is a significant market, such as Iran, export costs automatically go up. In the same manner, the bitumen grade also creates price fluctuation; for instance, bitumen grade 60/70, due to its extensive usage in the asphalt industry, is higher in demand and therefore has a different price compared to other grades.

Bitumen Market Situation

In consuming nations, the demand for bitumen increases as the hot seasons set in. municipalities, road construction projects, and the private sector buy their largest quantities of bitumen at this time. Due to this, the market for bitumen in summer—and typically throughout the hot season—is more active than in the cold months of the year. Additionally, drum packaging and transportation costs are a significant percentage of the final price.

In order to visit the market and view full details, click here:

https://www.bitumenmag.com/Articles/the-profitable-business-of-bitumen

Asia: The Battleground of Bitumen Production and Consumption

Asia houses the world's largest bitumen market. Iran, Iraq, India, China, Singapore, and the UAE are just a few of the giants. Even the net production of bitumen in these countries alone is enough to meet half of Europe's demand with ease. Nevertheless, exports to Africa—especially in recent years—have been very strong.

•Iran: As the largest exporter in the Middle East and a producer of high-quality bitumen, Iran plays a key role in meeting the needs of countries in the neighborhood.

•Iraq: Iraq has emerged as a significant bitumen-producing nation in the Middle East over the past two to three years, offering decent quality at prices lower than the competition.

•India: A large consumer, India's vast geography and aggressive road development plans have kept demand for bitumen high and stable, which cannot be met through local production.

•China: In addition to its domestic production, China is also one of the largest importers of bitumen in the world, and its economic trends can shake global markets.

•UAE and Singapore: These two countries are mostly trade and transit hubs, acting as a mediator between producers and final buyers.

Africa: An Emerging Market

Africa has become one of the most significant export destinations of bitumen in recent years. Infrastructure development in Kenya, Nigeria, Ghana, South Africa, and Tanzania has increased the usage of bitumen significantly. Most of these countries are non-producers and rely heavily on imports. On account of this, Asian countries are the prominent exporters in this market. However, the factor of high transportation cost, lack of infrastructure, and political instability can push the final cost higher to the African customer.

Bitumen Exports and Challenges in the Future

Major bitumen producers in the region have long been beset by issues of Middle Eastern tensions, insecurity, and instability. International restrictions and policy reversals in exports have regularly shocked the market. Rising international shipping rates and environmental limitations are other issues bearing down on this market. Buyers of this black commodity, such as India and African countries, constantly seek price stability, but recent volatility has generated uncertainty in the trade. Seasonal demand is another factor to consider: in Asia, summer and autumn are seasons of high consumption, while in Africa, due to diverse climatic conditions, there are various patterns of consumption.

Future of Bitumen Prices: What Does the Market Hold?

Experts believe that if the international price of oil continues its upward trend, bitumen prices will also follow suit. Stable exchange rates, though, may partly prevent sharp price hikes. Experts also observe that with the accelerated pace of development of infrastructure projects in Africa and Asia's ever-growing demands for development, bitumen consumption across these two continents will keep on rising. At the same time, competition among Asian manufacturers (China, India, and Iran) for a larger African market share has intensified. If oil prices persist on an upward trajectory, the bitumen market in both continents will increase.

Daily Bitumen Prices

August 2025

For daily bitumen prices, you can use the following websites:

•https://www.argusmedia.com/en

General Price Trend in August–September 2025 (August):

•Global Market (Marine FOB)

•Singapore (FOB, ABX 1, August 15): $430.50/M

•Bahrain (Fasht): $400/MT

•Iran (Bandar Abbas): $297.40–307/MT

•Regional Asia–Pacific Data

•Singapore: $425/MT

•South Korea: $407/MT

•Bahrain: $400/MT

•Persian Gulf (Iran)

•Bitumen 60/70 (Drum): $395–400/MT in the first and second week of August.

•China (Domestic Market, Yuan/MT)

•August 22: CNY 3,498/MT

Approximate price ranking:

Singapore 425–430 > South Korea 410 > Iran 395–400

•Africa

•Southern Africa (e.g., South Africa): $650–670/MT

•Nigeria: official reports vary, estimated ~$620/MT

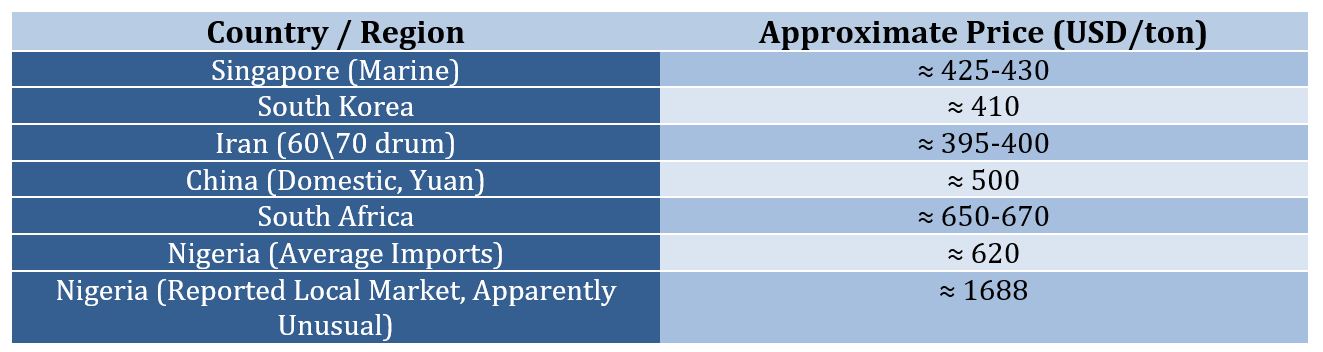

Comparative Price Table (August 2025)

Analytical Summary

• Highest Prices: China domestic ($500/MT) and South Africa ($650/MT). Singapore also has high levels ($427–430/MT), with good demand and costly transport.

• Regional Market Makers: South Korea and Iran are still in the mid-price range; South Korea at around $410/MT, Iran at around $400/MT.

• Nigeria: The large difference between reported local market prices ($1,688/MT) and import prices ($620/MT) can be explained by costly distribution chain costs or irregular data.

If the Canadian federal government enforces stringent regulations on emissions starting in 2030, the Canadian petroleum and gas industry could lose $ ...

Following the expiration of the general U.S. license for operations in Venezuela's petroleum industry, up to 50 license applications have been submit ...

Saudi Arabia is planning a multi-billion dollar sale of shares in the state-owned giant Aramco.